Terminology

Callable = the issuer has the right to redeem (i.e. exercise and thus terminate the product) at any time.

Autocallable = redemption automatically at a specific event.

Physical settlement = the buyer receives shares at maturity.

Cash settlement = the buyer receives a cash amount at maturity.

Convertible = the buyer can decide to convert the delivery in shares (physical).

Reverse = in contrast to convertible products, here the issuer decides to convert or not at maturity.

Pricing

The price of a SP is the sum of all its components’ prices. E.g. price (BRC) = price(ZC) + price(short put) = price(ZC) - price(put).

In practice, when a client wants a SP (e.g. to play a scenario), the price will be the combination [coupon, strike level, barrier level] (except if the client specify these).

Reverse convertibles (RCN)

Typically higher returns and lower maturities than traditional bonds.

Two parts:

-

a debt instrument

-

a put option

When buying a RCN, we are actually selling the issuer the right to deliver (i.e. we are selling a put) the underlying asset at some point in the future.

Before maturity, RCNs pay out the stated coupon rate (higher rate for more volatile underlying).

When the RCN matures, we receive either 100% of your original investment back or a predetermined number of the underlying stock’s shares. It’s “predetermined” since the number of shares can be computed from the beginning of the life cycle.

There are two structures used to determine whether you will receive your original investment amount or the stock:

-

Basic structure: at maturity, if the stock closes at or above the initial price, you will receive 100% of your original investment amount. If the stock closes below the initial price, you’ll get the predetermined number of shares. This means you’ll end up with shares that are worth less than your original investment.

-

Knock-in (or barrier) structure: we receive either 100% of your initial investment or shares of the underlying stock at maturity. The number of shares received at maturity is then (Original Investment Amount / Initial Price of Underlying Asset).

-

The coupon comes from:

the premium (shorting a put => premium received)

the yield of the risk-free instrument

issuer’s funding (return of a risky investment)

Note: at JB, coupons are announced with 2 documents: “crédits d’intérêts” and “prime d’options”. The two documents are distinct most probably because of tax reasons (“crédits d’intérêts” = interests => taxable // “prime d’options” = capital appreciation => not taxable?).

E.g. CH1210238098

6.6% Barrier Reverse Convertible BJB 2023/26-FEB-2024 UKX/DAX/SPX/NKY

Note: all the below information are written in the product’s term sheet.

-

Underlyings = DAX, FTSE 100 Index, Nikkei 225 Index, S&P 500 Index

-

“Reverse convertible”: at maturity, the issuer can decide to convert and redeem in underlyings (note: this does not make much sense in case of cash settlement since there is nothing to “convert”).

-

“Barrier”: at maturity:

-

if no barrier event has occurred -> the buyer receives in cash 100% of the denomination

-

if a barrier event has occurred and the final level of each underlying is at or above its strike -> the buyer receives a cash amount equal to 100% of the denomination

-

if a barrier event has occurred and the final level of at least one underlying is below its strike -> the buyer receives a cash amount equal to the denomination multiplied by the ratio of the final level of the worst-performing underlying divided by its strike i.e.:

-

=> for the investor (the buyer), the best solution would be to be redeemed the entire denomination at maturity. This happens if:

No barrier event has occurred

A barrier event has occurred but the final price is above the strike price => the issuer will thus not exercise the option and redeem the product value

-

Callable: the issuer has the right to terminate the product at any time (note: at specific dates for Bermudan options).

-

Bermudan option: the issuer can decide to terminate the product and redeem the entire value of the product at specific dates: 16 May 2023, 20 June 2023, 18 July 2023, …

Dual Currency Investment (DCI)

This strategy involves 2 currencies. This is a good strategy to take if the investor wants to enjoy a higher return while not minding holding either currency.

The strategy involves 2 aspects:

-

entering a fixed term deposit in the base currency

-

selling an FX option: we typically sell a put (just like a classical structured product)

Important:

-

we don’t know in what currency will the investment be returned

-

this strategy is typically done over a short term (< 1 year)

Example (extracted from here):

Amount to invest: 600,000

Base currency: USD

Alternate currency: AUD

Spot rate: 0.6400

Strike: 0.6250

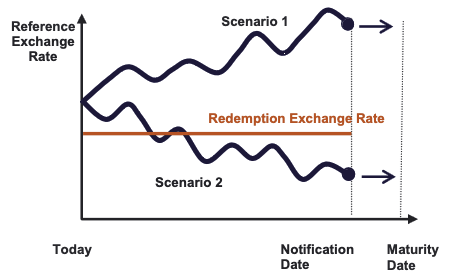

Scenario 1: if the spot goes above the strike, the option is not exercised and the money in the deposit is given back without conversion i.e. in USD.

Scenario 2: if the spot goes below the strike, the option is exercised by the holder (i.e. the bank) and the money in the deposit is converted in AUD. The investor thus makes a loss because the USD are converted at a lower rate than the spot rate.

Note: the product behaves almost like a Reverse Convertible, the differences are:

-

the bond part is not to guarantee a certain capital but really to gain some return

-

the option is an FX option

-

the option part is here to increase the return even further.

AMC

No option part.

The buyer decides the underlyings.

Example

“Energetic de CA”

Capital guaranteed => safe investment!

Up to 60% performance of Eurostoxx 50!

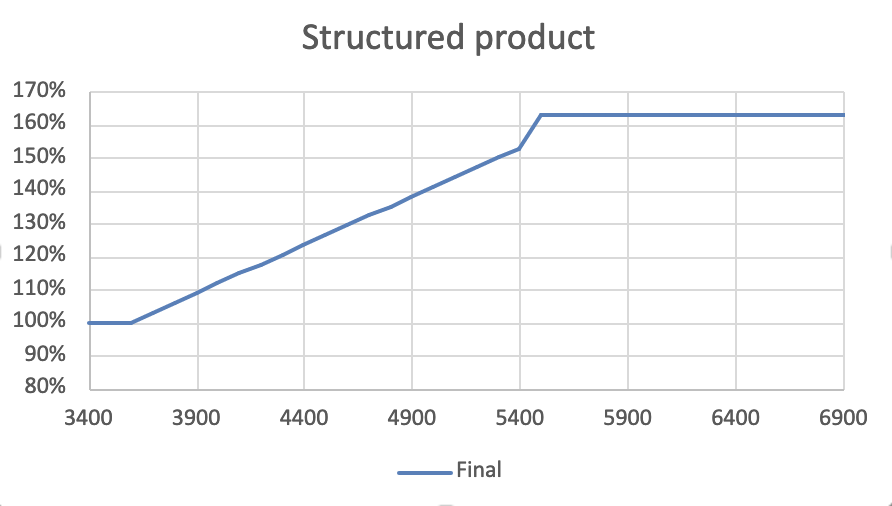

\[perf = \left\{ \begin{array}{ll} 0\% & \text{if } perf_{SX5E} < 50\% \\ perf_{SX5E} & \text{if } 0\% < perf_{SX5E} < 50\% \\ 60\% & \text{if } perf_{SX5E} > 50\% \end{array} \right.\]-

Maturity: 6Y

-

Current spot: 3600

Product’s payoff:

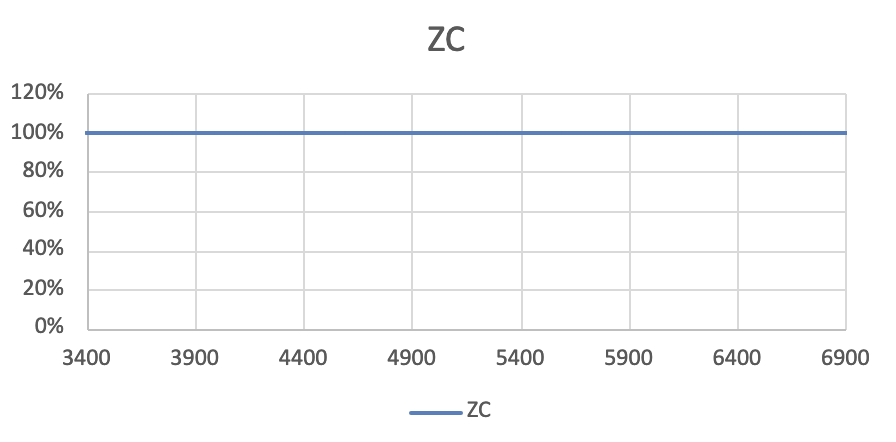

1/ Zero coupon (long position)

Price = present value computed using the ZC rate on the ZC yield curve.

\[price_{ZC} = 100\% e^{-5.03\% * 6} = 73.95\%\]

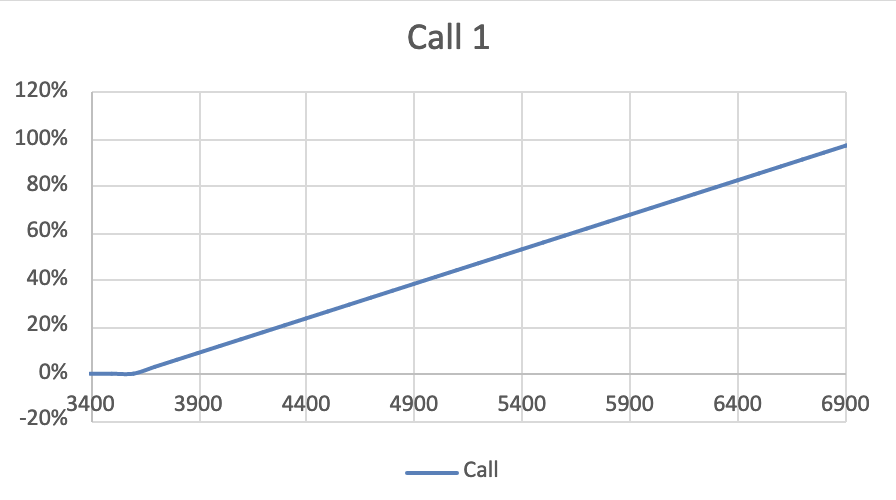

2/ Call 1 (long position)

The price is expressed as % of the spot.

The volatility is taken from the volatility surface.

\[price_{call 1} = S_t \mathcal{N}(d_1) - Ke^{-rT} \mathcal{N}(d_2) = 1373.31 \text{ --> } 1373.31/3600 = 38.15\%\]

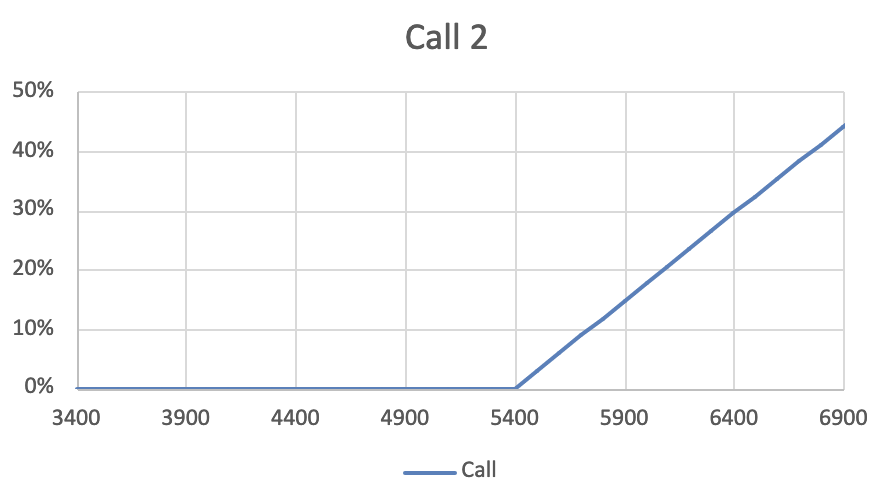

3/ Call 2 (short position)

\[price_{call 2} = S_t \mathcal{N}(d_1) - Ke^{-rT} \mathcal{N}(d_2) = 694.32 \text{ --> } 694.32/3600 = 19.29\%\]

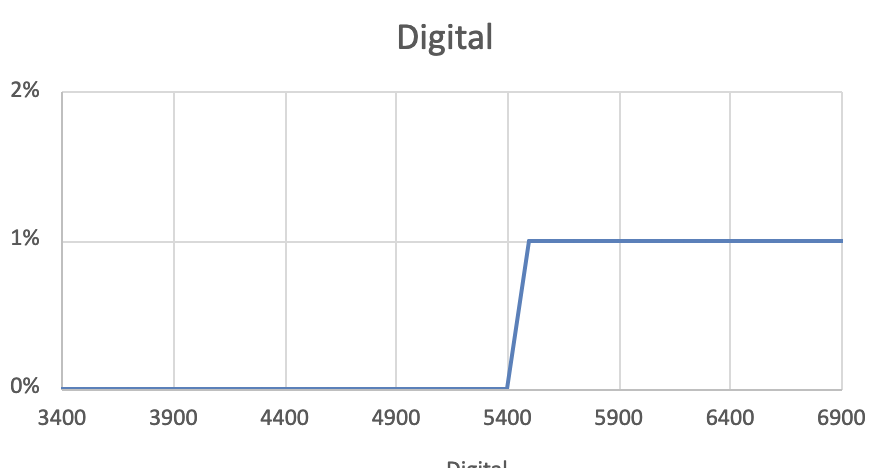

4/ Digital (long position)

\[price_{digital} = \frac{1}{100} \mathcal{N}(d_2) = 0.236\%\]

The product is sold 100% so the margin is $100\% - 95.17\% = 4.83\%$