The price of a bond can fluctuate in the market by changes in interest rates. Its nominal remains fixed.

Bonds are usually quoted as percentage of their nominal (or face value).

Minimum investment can be expressed as quantities (i.e. number of units) or in monetary value.

Example

A bond has the following characteristics:

-

Nominal: CHF 1,000

-

Minimum investment: CHF 1,000. Note: here it’s expressed as monetary value, but it’s equivalent of Minimum investment unit = (Minimum investment / Nominal).

-

Last price: 88%

The minimum to be purchased is CHF 1,000 * 88% = CHF 880.

Note (2): when a bond is sold at a discount (price < nominal), it means that the buyer pays less than the principal he receives at maturity. Warning: a bond price that is too low (<80%) could show a bad credit quality.

Pricing

There are 2 main pricing methods, both based on DCF (discounted cash flows).

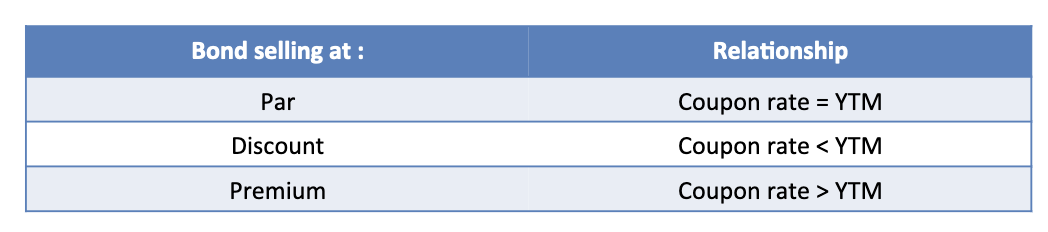

When the same rate is used to discount all cash flows, the rate is called yield-to-maturity.

\[P = \sum_{i=1}^T \frac{C_t}{(1+i_{YTM})^t} + \frac{N}{(1+i_{YTM})^T}\]When different rates are used to discount each cash flow, the rates are the zero-coupon rates. According to the Hull book, this method is more accurate than the one with YTM.

\[P = \sum_{i=1}^T \frac{C_t}{(1+i_{ZC(i)})^t} + \frac{N}{(1+i_{ZC(T)})^T}\]To price a bond using ZC rates, one would need ZC rates for different maturities corresponding to the different cash flows. Those ZC rates can be obtained on the ZC yield curve.

The bootstrapping method allows to build the ZC curve using bond prices (and YTM) thanks to the formula above. It’s an iterative method in the sense that we start finding ZC(1Y), then ZC(2Y), ZC(3Y) etc.

Note: unlike the coupon $C$, the YTM allows to compare several bonds because it encompasses the maturity, the coupon and the price.

Its usual formula is:

\[YTM = \frac{C+\frac{F-P}{T}}{\frac{F+P}{2}}\]Where:

-

$C$: coupon

-

$F$: face value (=nominal)

-

$T$: maturity

-

$P$: price

We can thus see that the YTM depends on the maturity, the coupon, the nominal and the current price. $YTM = f(\color{green}{C}, F, \color{red}{P}, \color{red}{T})$ (<p style="color:green">green</p> for positive relationship).

Coco bonds

Coco bonds are convertible bonds i.e. the least secured bonds. The conversion typically happens if the issuer’s quality is deteriorating too much.

Coco bonds e.g. AT1 bonds (“Additional Tier 1”) are usually a good investment for banks or insurances that invest their own funds (treasury) because they give high returns while contributing to the bank’s capital tier 1, which is supposed to be the safest part of the bank’s capital.