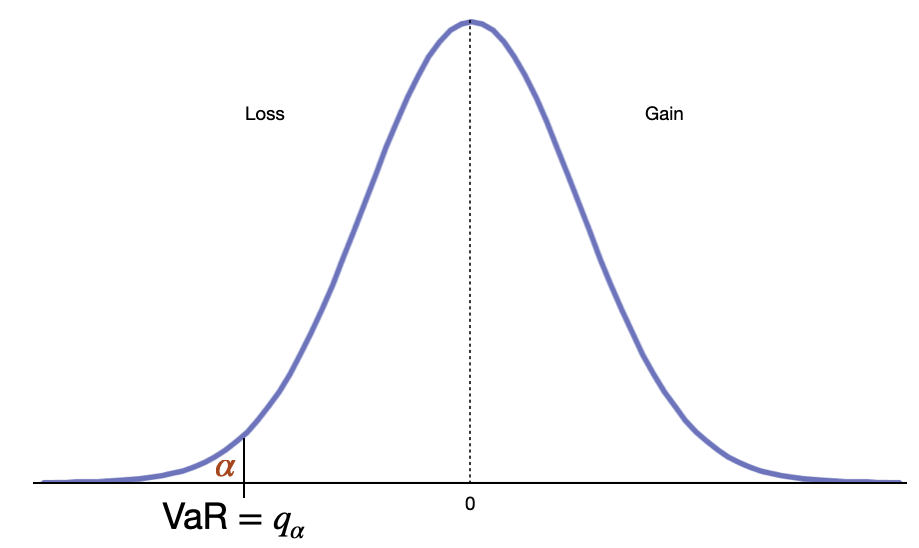

The Value-at-Risk is the maximum loss in extreme scenarios.

Most often, it represents the loss amount that one would face with a certain probability $\alpha$ over a certain length of time. Hence, it combines 3 aspects: amount, probability, time window.

Mathematically:

\[VaR_\alpha(X) = \inf \{ x \in \mathbb{R}, F_X(x) > \alpha \}\]where $X$ are the returns of the strategy over a certain time window, and $F_X$ its cumulative distribution function.

From a statistical perspective, the VaR is simply the quantile associated with a certain $\alpha$. As a reminder, the quantile function is the inverse of the cumulative density function.

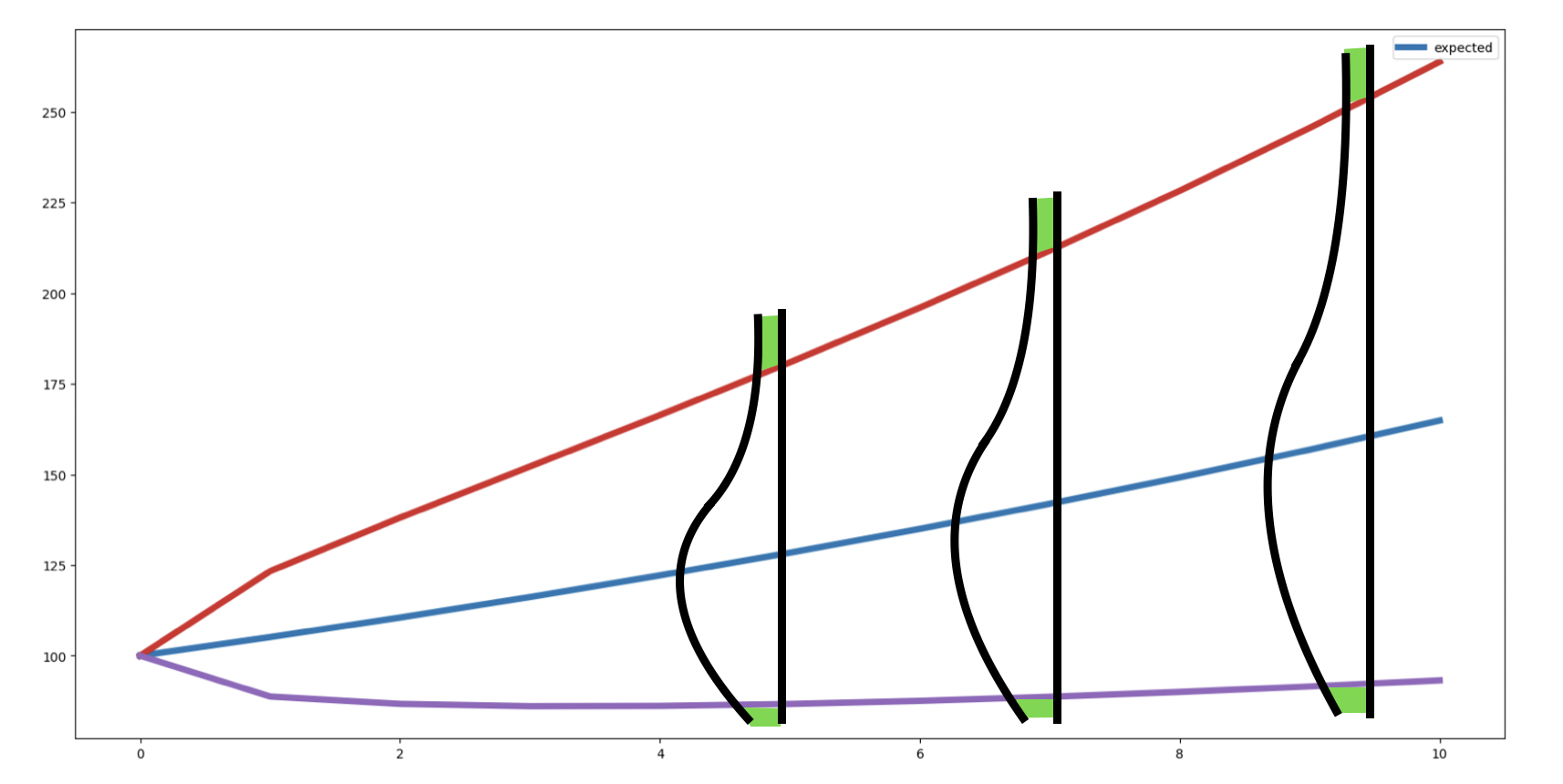

To compute the VaR in the case of a GBM, see the Wealth planning section where we compute the quantiles at each step of the projection.