Wiki: Monte Carlo methods are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results.

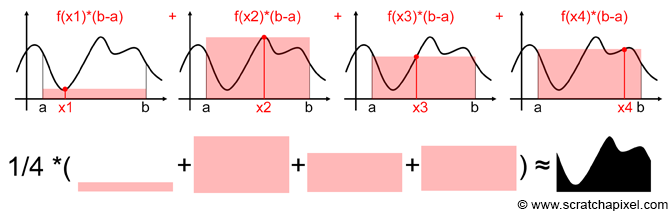

Monte Carlo Methods in Financial Engineering: Monte Carlo methods are based on the analogy between probability and volume [ndlr: volume=integral]. […] In the simplest case, this means sampling randomly from a universe of possible outcomes and taking the fraction of random draws that fall in a given set as an estimate of the set’s volume. The law of large numbers ensures that this estimate converges to the correct value as the number of draws increases. The central limit theorem provides information about the likely magnitude of the error in the estimate after a finite number of draws.

Investopedia: Monte Carlo simulations are used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.

My definition: Monte Carlo simulations are generated scenarios based on probability distributions. Those simulations are then aggregated to estimate a value (e.g. expected value).

MC are especially used to compute integrals in high dimensions. Example: Asian options’ value depends on the average of the whole path of a stochastic process. The high dimension is caused by the large number of discrete time steps required to properly discretize the process (source):