Main concepts

A cryptocurrency is a digital (i.e. not physical) currency that is built on blockchain technology.

The blockchain is a system that allows transactions to be traced and validated. One of its key aspects is that it is decentralized, meaning that many participants are responsible for ensuring the correctness of the transaction history.

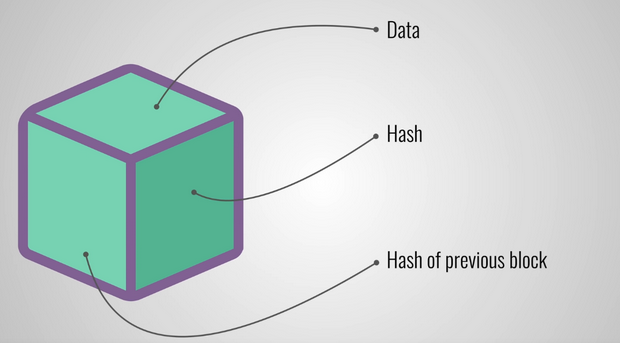

Each block in the blockchain consists of its data, its own hash, and the hash of the previous block.

A simple code (ChatGPT) to illustrate the concept:

import hashlib

import time

class Block:

def __init__(self, index, data, previous_hash):

self.index = index

self.timestamp = time.time()

self.data = data

self.previous_hash = previous_hash

self.hash = self.compute_hash()

def compute_hash(self):

block_string = f"{self.index}{self.timestamp}{self.data}{self.previous_hash}"

return hashlib.sha256(block_string.encode()).hexdigest()

class Blockchain:

def __init__(self):

self.chain = [self.create_genesis_block()]

def create_genesis_block(self):

return Block(0, "Genesis Block", "0")

def add_block(self, data):

prev_block = self.chain[-1]

new_block = Block(len(self.chain), data, prev_block.hash)

if self.validate_block(new_block, prev_block):

self.chain.append(new_block)

def validate_block(self, block, prev_block):

if block.previous_hash != prev_block.hash:

return False

if block.hash != block.compute_hash():

return False

return True

def is_chain_valid(self):

for i in range(1, len(self.chain)):

if not self.validate_block(self.chain[i], self.chain[i-1]):

return False

return True

def display_chain(self):

for block in self.chain:

print(f"Index: {block.index}")

print(f"Timestamp: {block.timestamp}")

print(f"Data: {block.data}")

print(f"Hash: {block.hash}")

print(f"Previous Hash: {block.previous_hash}")

print("-" * 40)

# Simulating a decentralized consensus (very simplified)

def simulate_decentralized_validation(blockchain):

print("Chain valid according to Node A:", blockchain.is_chain_valid())

print("Chain valid according to Node B:", blockchain.is_chain_valid())

print("Chain valid according to Node C:", blockchain.is_chain_valid())

# Usage

bc = Blockchain()

bc.add_block("Alice pays Bob 10 coins")

bc.add_block("Bob pays Charlie 5 coins")

bc.display_chain()

simulate_decentralized_validation(bc)

Smart contracts

While BTC relies solely on blockchain technology, ETH relies on blockchain technology enhanced with smart contracts.

Smart contracts are rules (if/else) that run on the blockchain and automatically execute transactions when certain conditions are met.

Consensus mechanisms

The consistency of a blockchain is maintained by participants who validate transactions using different consensus mechanisms, such as:

-

Proof of Work (PoW): where participants (miners) provide computational power to solve cryptographic puzzles and secure the network.

-

Proof of Stake (PoS): where participants (validators) are selected to propose and validate blocks based on the amount of cryptocurrency they have staked.

In both PoW and PoS, the validation of transactions is performed automatically through software nodes that follow the rules of the blockchain protocol.

Perpetual futures

Perpetual futures are only available in DeFi and not in traditional finance. They have no maturity date and typically allow higher leverage than spot assets.

Perpetual futures have associated funding rate i.e. periodic payments to account for the difference between the underlying price and the contract price.

In traditional finance and when doing leverage, if the trader has a negative balance, the broker would pursue the trader for the debt. But in crypto perpetuals, traders cannot go below zero. To cope with this, an insurance fund steps in to cover the loss. The insurance fund is funded with “successful liquidations” that are liquidations when the exchange liquidated the position before the “official” threshold -> the exchange takes the difference and sends it to the insurance fund. We can thus say that in DeFi, the trader is more penalized if he reaches the maintenance margin because the exchange might take more than what’s actually needed to cover the loss. Additionally, the margin call is not really a “call” in DeFi as the exchange automatically liquidates part or all of the positions once the margin balance falls below the maintenance margin.

ETPs

ETPs stands for Exchange Traded Products and refers to trackers on digital assets. It’s the equivalent of ETFs in traditional finance. Investors typically buy ETPs and not directly the spot for several reasons:

-

Convenience: investors who are more familiar with traditional finance can buy such products on the main exchanges.

-

Regulatory safety: ETPs are pysically backed and securely custodied. This reduces personal risks like wallet loss, theft, etc.

-

Tax efficiency: in many countries, holding a regulated ETP/ETF may be tax-advantaged compared to holding crypto directly.